ABOUT

This is a New York based specialist center dedicated to the research and treatment of gastroenterology diseases.

DURATION

10 months

AREAS FOCUSSED

• Process understanding

• Inventory understanding

• Reimbursement trend

• Expense/cost analysis

RECOMMENDATIONS

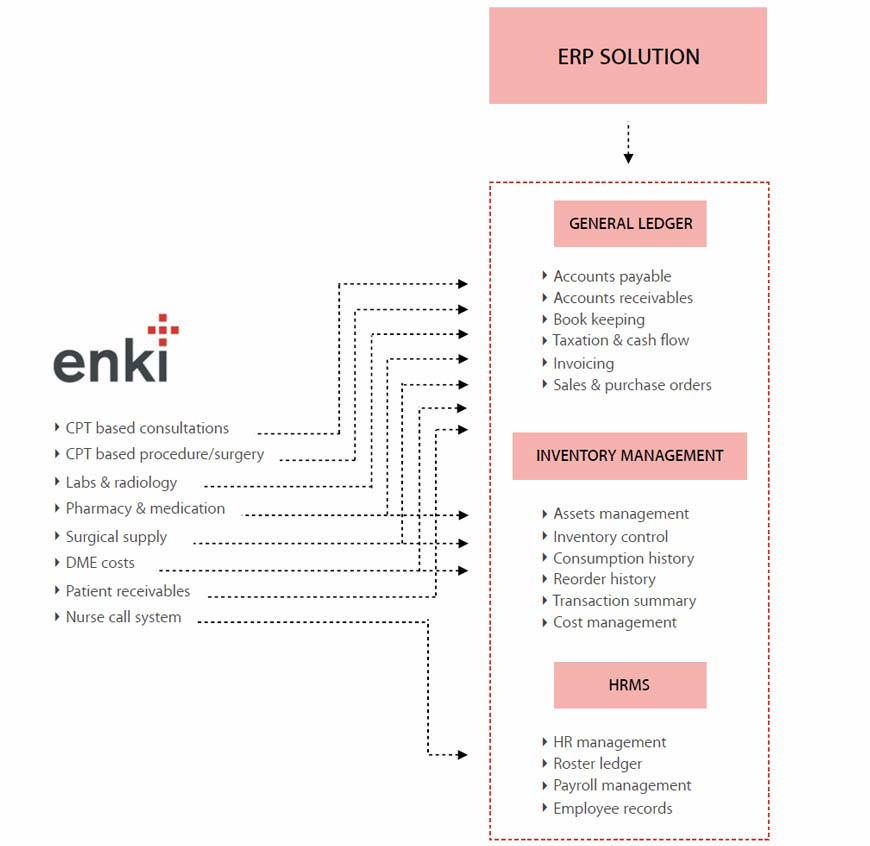

• Process re-engineering

• Inventory management

• Charges vs. payment analysis

• Resource management

• Expenditure management

• Collection optimization

STAFFING

Three specialist physicians, two nurses, four front desk personals and one medical technician.

PRE-VISIT AND CHECK-IN

1. Pre-visit and check-in procedures were completed by the front office staff. The appointments mainly scheduled were follow-up visits, only a handful of patients’ scheduled prior appointments via phone.

2. There was no fixed personal designated to attend calls by patients, checking patients’ eligibility, verifying patient charts, etc. All these activities were carried out by anyone present at time on the desk.

3. For all established patients the demographics were verified at the time of service.

4. Patients with invalid insurance information were flagged and insurance / patient information was collected at the time of visit or over the phone.

5. A concrete eligibility verification and prior authorization process was not devised which led to ineligible patients getting services.

BILLING

1. The physicians themselves entered the charges into the practice management software.

2. The claims submitted were not “clean” due to the lack of co-ordination between the clinical and the billing staff.

3. The most common and persistent errors encountered were as follows:

‣ Duplicate billing.

‣ Incorrect units billed on certain claims.

‣ Lack of monitoring on the submitted and un-submitted claims.

‣ Inconsistencies with the use of modifiers.

‣ Delayed claim submission resulting in backlogs.

‣ Incomplete/unsigned charts.

‣ The claims were not submitted as the Local Coverage Determination guidelines.

4. The accounts receivable activities were undertaken at the central billing office of the medical center.

The process was not clearly laid out at fundamental levels which lead to inconsistencies.

‣ Insurance follow ups on claims were not regular.

‣ Patient receivables were not monitored and tracked.

‣ The claims which had been paid to patient went uncollected.

‣ Patients received incorrect statements.

INVENTORY MANAGEMENT

1. The practice had a substantial volume of patients being treated for inflammatory bowel disease (IBD). A common drug administered as a plan of treatment was remicade.

2. The stocking of drugs was done on a monthly basis with no accurate mechanism to track the inventory vs consumption ratio. This disturbed the process of drug procurement and payments.

3. As the authorization and benefit process was not laid down there were certain uncovered drugs being prescribed leading to lost payments.

RECOMMENDATIONS: PRE-VISIT AND CHECK-IN

1. Organize a workflow. The current front desk process flow was unorganized where no definite responsibilities were assigned to anyone. Process reorganization was suggested.

2. Correct capture of information. Suggested a process to train the front desk on correct and complete demographic capture.

3. Co-ordination between processes. Conduct eligibility verification on all claims and coordinate between the billing and the AR services.

RECOMMENDATIONS: BILLING

1. Be selective and efficient in claims submission. An option to correct the billing process suggested was to be extra cautious while submitting higher dollar value claims. Under no condition the claims submitted should be incomplete.

2. Make healthy comparisons. Analyze the global flow of charges submitted and payments received and compare with previous months, quarter averages.

3. Post payments on date of receipt. Flag for denials and secondary submissions for non-crossover claims. Compare payments against contractual allowed amounts and flag underpayments.

4. Follow up on AR. Run an aged AR report on weekly basis. Map the average payment turnaround time for insurances and identify records that exceed average payment duration

5. Collecting outstanding balances from the patients upfront. Alert patients on the types of statements they are likely to receive. Make attempts to collect when patient arrives for the service. Send balance statements within a week of service and follow-up with a call.

6. Recover paid to patients. Based on insurance, alert patients that they would receive check on behalf of the non-participating physicians and have patient sign an acknowledgement form for the same. Follow-up with insurances and procure the check number of the issued check and send a reminder letter about the check. Partner with patient to collections agencies for un-retrieved checks

7. Negotiate with insurances. For non-participating providers, negotiate aggressively with insurance companies and third-party administrators to extract maximum percentage of fee schedule. compare and analyze payments from different insurances, different plans and use the information during negotiations.

RECOMMENDATIONS: DRUG INVENTORY MANAGEMENT

1. Tracking and evaluation. Discard paper-based tracking. Utilize a software-based system to track the following:

‣ Drug usage by patient, physician, practice, insurance

‣ Payments of drug usage by patient, physician, practice, insurance

‣ Unpaid drugs in any given month by patient, physician, practice, insurance

‣ Expense of drug based on usage.

‣ Estimate of drug requirement based on previous average usage

2. Negotiations with existing and new vendors to get better deals on drugs.

3. Perform profitability analysis at a drug-level.

(more…)